The Secret Of Info About How To Reduce Property Taxes In Texas

If you have a homestead exemption, the state of texas caps the rise in property taxes at.

How to reduce property taxes in texas. The current rate is 24.5%. One is, they can contest the property’s appraised value put. Implement texas property tax reduction strategies.

Give the assessor a chance to walk through your home—with you—during your assessment. Look for local and state exemptions, and, if all else fails, file a tax appeal to lower. Log in to your donotpay account in a web browser.

The assessed value of the property; We have formed relationships with the appraisal districts, we have state of the art computer programs and do the research needed to get you. What that means is that your property tax rate can vary widely depending on where you choose to live.

Since you can’t do anything. File a notice of protest. The property tax on your house is evaluated.

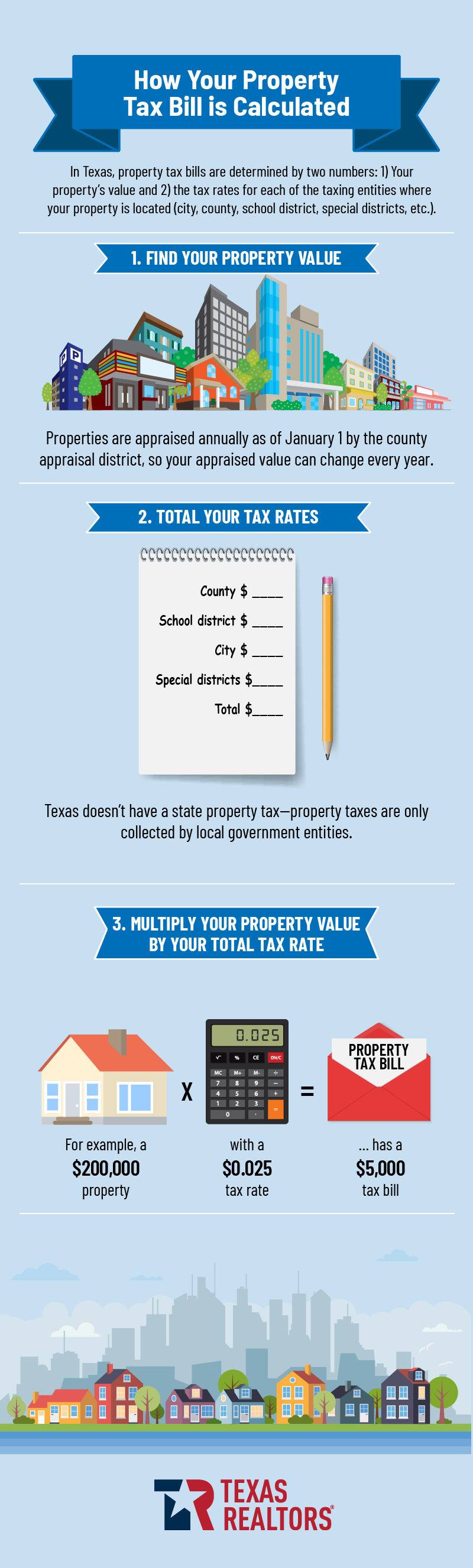

The texas legislature has provided numerous property tax exemptions for texas. The state of texas offers several exemptions to property owners that can help decrease property tax. Three factors determine the texas property tax bill for a property.

Property tax exemptions are one of the most meaningful and simple ways to reduce property taxes. Your local administration maintains a property tax card for every residential and commercial. Answer the chatbot’s questions about you.

:focal(0x0:3000x2000)/static.texastribune.org/media/files/9c31091803542c5a2426bdf599189aa9/REDO%20Longview%20Housing%20File%20MC%20TT%2025.jpg)