Beautiful Tips About How To Buy Delinquent Tax Properties

Tax delinquent properties for sale search.

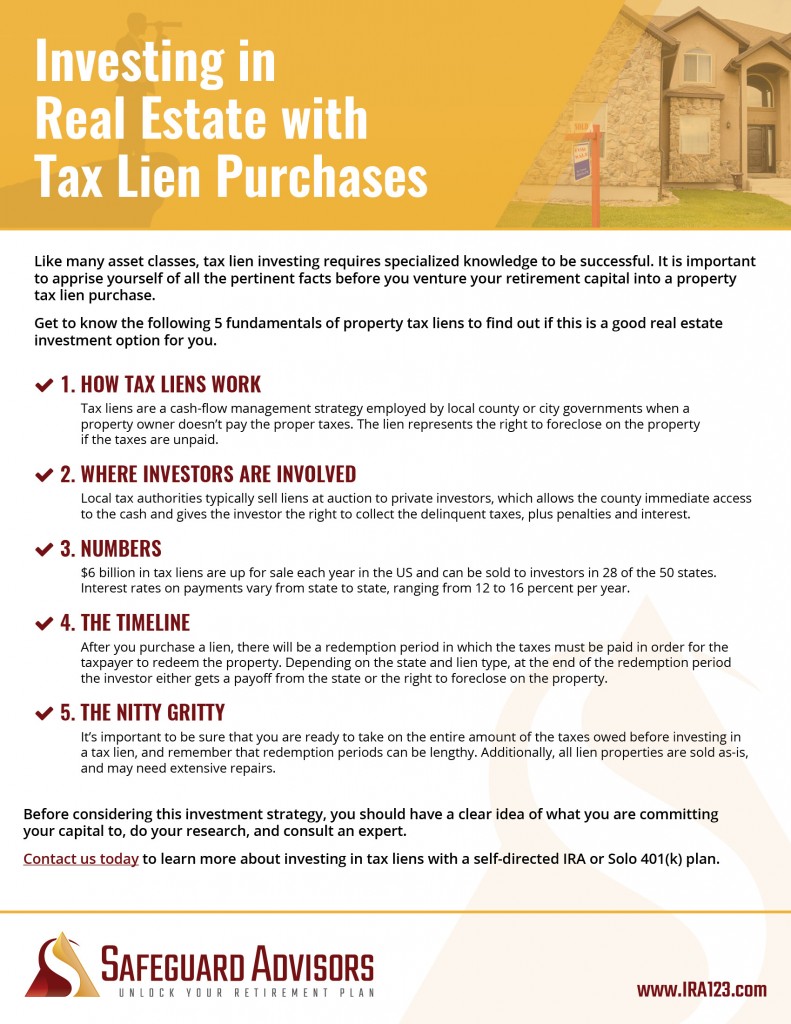

How to buy delinquent tax properties. Through interest payments or taking ownership of the property. The specifics about each county’s sale, along with a listing of each certificate of delinquency, are required to be advertised in the local newspaper at least 30 days prior to the tax sale date. At the live auction, you can bid on the certificate.

How to buy a tax lien property. As an investor, you can. How do you buy properties with delinquent taxes?

The tax office discounts the amount of tax. April 13, 2022, 6:17 pm · 7 min read. The property is then sold to you.

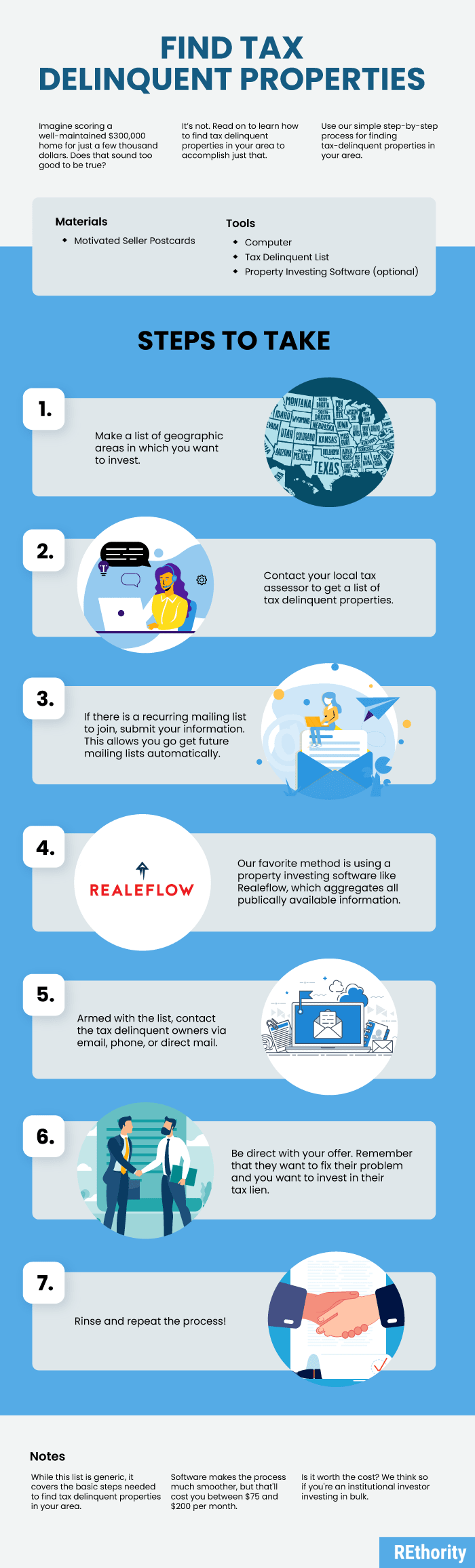

When a homeowner defaults on property taxes, the county may place a tax. Before investing in property via a tax lien or a tax deed, you first. This could end in a tax sale with an investor paying the taxes to get the home.

The bank agrees to a short sale to get rid of the property. Learn about tax liens and real estate auctions: Provide a bidders registration, which may be downloaded from the delinquent tax sales website or filled out before 9:45 a.m.

You increase your offer by $6,000 to cover the taxes. When a property has a tax lien, it cannot be sold or refinanced until the taxes are paid and the lien is discharged. To buy a tax lien property, youll attend an auction.